Sinopec to increase investment in coal chemical industry

Sinopec to increase investment in coal chemical industry

(Summary description)At present, Sinopec has coal resources only in Xinjiang, Inner Mongolia and Ningxia, and plans to launch coal-to-chemical projects, as well as two coal-to-gas pipelines in new Zhejiang, Guangdong and Xinjiang. According to this estimate, the investment amount of the above-mentioned project is far less than 600 billion yuan.

- Categories:2013 Year

- Author:

- Origin:

- Time of issue:2013-09-25 10:38

- Views:0

At present, Sinopec has coal resources only in Xinjiang, Inner Mongolia and Ningxia, and plans to launch coal-to-chemical projects, as well as two coal-to-gas pipelines in new Zhejiang, Guangdong and Xinjiang. According to this estimate, the investment amount of the above-mentioned project is far less than 600 billion yuan.

“Sinopec will increase its investment in coal chemical industry, which will reach 600 billion yuan in the next 10 years. This may be the largest investment in China's coal chemical industry to date,” a source close to the situation said on May 22.

“This involves disclosure and has an impact on the share price, which we have never published,” said a person at Sinopec headquarters. “But the development of coal-to-chemicals is a trend, and the oil-to-oil industry is at a cost disadvantage, driven by petrochemical capacity in the Middle East and the shale gas revolution in the US.”.

However, some investment bank analysts pointed out that Sinopec's subsidiary refining and chemical engineering (02386.HK ) will soon list on the Hong Kong market on the 23rd, “In the future, there will not be many domestic oil and chemical engineering projects, and refining and chemical engineering will mainly undertake the engineering business of Sinopec's coal and chemical engineering projects.”.

It is reported that 1.328 billion new shares, or 30% of the enlarged share capital, will be issued in the refinery project listing, it should have a market capitalisation of rmb50bn-rmb70bn, roughly the same as CNOOC 02883.hk .

The oil-based chemical industry can no longer compete with coal or shale gas. On May 19, the Ningxia Energy and Chemical Co. , Ltd. was officially established. Sinopec general manager Wang Tianpu and Guodian general manager Chen Feihu accompanied former National People's Congress vice chairman Sheng Huaren to attend the unveiling ceremony.

This is what kind of company, the founding ceremony so high specifications. The company is a 50-50 joint venture between Sinopec and China Guodian Corporation. “The company will form an integrated coal-thermal-fine chemical industry chain with high value-added products such as vinyl acetate, polyvinyl alcohol, 1,4-Butanediol (BDO) and polytetrahydrofuran (PTMEG) , a coal-based fine chemical project with advanced technology and equipment and a complete industrial chain in China,” Sinopec said in a press release.

This is one of Sinopec's means of coping with the coming low-cost shock challenge, the source added. “It is losing its previous cost advantage and starting to be challenged by lower-cost competitors.”

According to him, after the success of the Shale Gas Revolution in 2009, Dow Chemical, dupont and others began to shift their planned investments in China or the Middle East to the United States and Canada in North America because of their use as petrochemical raw materials, in North , shale gas is much cheaper than oil, and feedstock costs account for more than half of the total cost of many bulk chemicals.

“When shale gas prices were at their lowest, US gas prices were just $2 per million thermal units, which is less than $30 per barrel for oil, and now international oil prices are hovering around $100 per barrel. How can that be compared?” He said. Sinopec's 2012 annual report confirms this. The total profit of Sinopec was 63.496 billion yuan in that year, of which only 1.2 billion yuan was realized in the chemical industry sector with revenue of 412 billion yuan. Profits in the chemical sector fell 95.6 per cent year-on-year as prices fell sharply, the company said in its annual report.

To meet this challenge, Sinopec, the country's largest supplier of petrochemical products, is planning a shift to coal-based chemicals.

A senior executive of a multinational chemical giant in China pointed out that compared with the international oil price, which is still 100 US dollars per barrel, the current domestic coal price of 500-600 Yuan per ton is much lower. The same end products, coal-based production costs will be several hundred yuan less per ton than oil-based production costs.

“Domestic coal resources are relatively abundant, and in the western region, local governments are willing to offer more favorable policies for these projects, so Sinopec is certainly willing to actively invest,” he said.

It is understood that in addition to the Ningxia project, Sinopec has also set up another coal chemical project in Ordos, Inner Mongolia, in a joint venture with four other companies including China Coal Energy, sinopec has already started a 12bn cubic metre coal-to-gas project and plans to build two more coal-to-gas pipelines in Guangdong and Shandong provinces.

In an effort to unify management thinking, Sinopec in early April also organized a group of party members to hold a special lecture on coal chemical industry. Wang Tianpu said that to develop coal chemical industry vigorously was for the group's Party group to proceed from China's national conditions, a“Strategic decision” made in the light of the company's actual situation.

Refining and chemical engineering will be listed on the 23rd, such a large investment plan will be able to stimulate stock prices. “The expansion into coal chemicals is certain, but it will not be 600 billion yuan in 10 years. That means Sinopec will spend all its profits on coal chemicals in the next 10 years. How is that possible?” Said the investment bank analyst. “The 600 billion yuan is more to create momentum for the listing of refining and chemical projects. After the listing is successful, who will force Sinopec to invest 600 billion yuan in coal chemicals?”

It is understood that Sinopec has invested in the coal chemical industry, including the new Zhejiang-guangdong coal gas pipeline and three coal chemical projects in Inner Mongolia, Ningxia and Xinjiang, among them, the new zhejiang-guangdong coal-to-gas pipeline project, which has been officially launched, has a total investment of 159 billion yuan. This is also its largest investment in coal-to-chemical business at present. Other coal-to-chemical and coal-to-gas projects each have a scale of less than ten billion yuan, add in the new LU pipeline, which has yet to be launched, and the total investment will not exceed 300 billion yuan.

“So where does the remaining 300 billion yuan go?” The analyst asked.

He pointed out that since China's chemical production capacity no longer has an overall cost competitive advantage and China's refining capacity is already in surplus, therefore, in the past mainly to undertake refining and chemical engineering refining and chemical engineering to expand new market space, coal chemical industry is the focus of its direction.

Latest News

Discuss and jointly build | Fujian WIDE PLUS and experts from Northeast Process Automation Design Committee lead the localization process

More services please pay attention to Fujian WIDE PLUS won the Fuzhou Mawei High-tech Park "Harmony Cup" employee tug-of-war invitational third public number

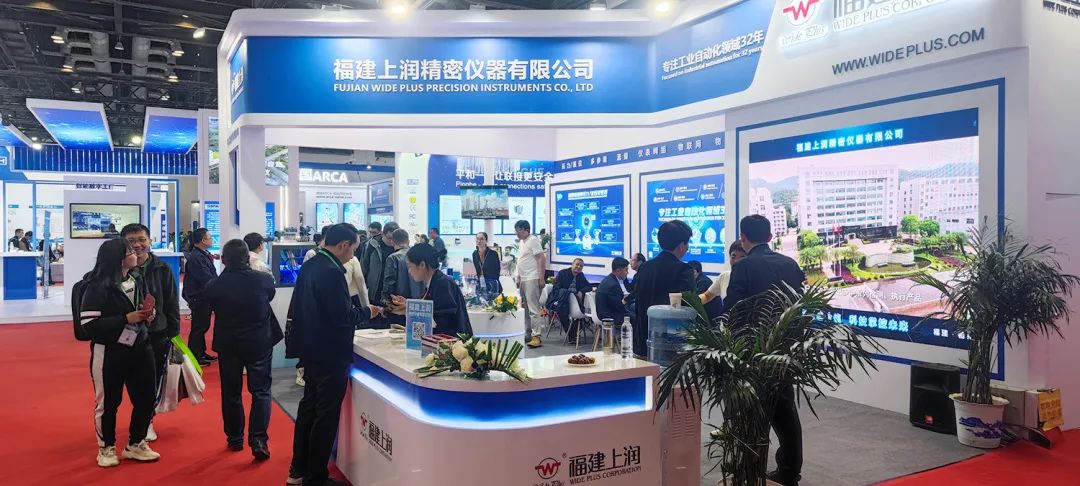

The 31st China International Measurement Control and Instrumentation Exhibition was successfully concluded, and Fujian WIDE PLUS harvested a lot

The main business of Fujian WIDE PLUS Precision Instrument Co., Ltd. involves the R&D and manufacturing of pressure, flow, temperature, liquid level, photoelectricity, water quality and other parameter sensors as well as instrumentation tubes and valves in the industrial field; the R&D and manufacturing of high-precision automation equipments; high-precision mechanical machining; and the products and overall solutions of the city's intelligent water affairs.

Fujian WIDE PLUS Precision Instrument Co., Ltd.

ADD:No.16, Xingye West Road, Mawei High-tech Zone,Fuzhou,Fujian China

Email:info@wideplus.com

Toll-free technical service number:

400-887-6339

Follow Us On

Copyright © 2023 Fujian WIDE PLUS Precision Instrument Co., Ltd.

闽ICP备05035149号-1 Powered by saa